When Kasparov challenged the IBM chess-playing computer called Deep Blue, he was absolutely certain that he would win. An article in USA Today on 2 May 1997 quoted him as saying “I’m going to beat it absolutely. We will beat machines for some time to come.”

He was beaten conclusively.

In early 2016 another landmark was reached in game-playing computing, when AlphaGo (DeepMind) challenged Lee Se-dol to a game of Go. The Asian game is a magnitude more complex than chess, and resulted in Lee making the observation that “AlphaGo’s level doesn’t match mine.”

Other expert players backed Lee Se-dol, saying that he would win 5-0. In the end he only won a single game.

Now the same team that developed AlphaGo is setting it’s sights on a computer game called StarCraft 2. This is a whole new domain for artificial intelligence because, as The Guardian points out:

StarCraft II is a game full of hidden information. Each player begins on opposite sides of a map, where they are tasked with building a base, training soldiers, and taking out their opponent. But they can only see the area directly around units, since the rest of the map is hidden in a “fog of war”.

“Players must send units to scout unseen areas in order to gain information about their opponent, and then remember that information over a long period of time,” DeepMind says in a blogpost. “This makes for an even more complex challenge as the environment becomes partially observable – an interesting contrast to perfect information games such as Chess or Go. And this is a real-time strategy game – both players are playing simultaneously, so every decision needs to be computed quickly and efficiently.

Once again, humans believe that the computer cannot beat humans. In the Guardian article, the executive producer for StarCraft is quoted as saying “I stand by our pros. They’re amazing to watch.”

Sound familiar?

If AI can win at a game like StarCraft, it’s both exciting and troubling at the same time.

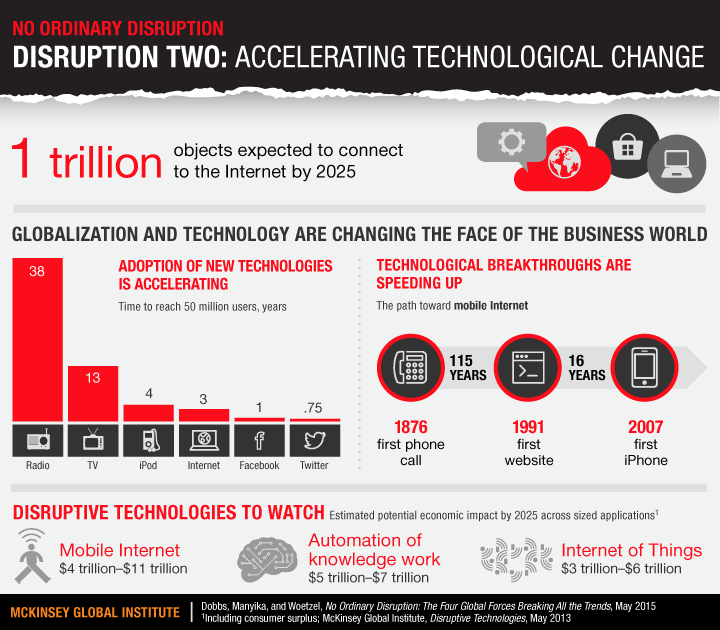

It will mean that an AI will have to reference ‘memory,’ take measured risks and develop strategy in a manner that beats a human. These three things – pattern recognition (from memory), risk taking, and strategy, are skills that command a premium wage in economies that value ‘knowledge workers.’

In 2015 a research team at Oxford University published a study predicting 35% of current jobs are at “high risk of computerisation over the following 20 years.” The StarCraft challenge might cause them to revise this prediction upwards.